Explore Health Savings Accounts (HSAs)How Can I Reduce My Taxable Income? 15 Tips to Lower Your Taxes

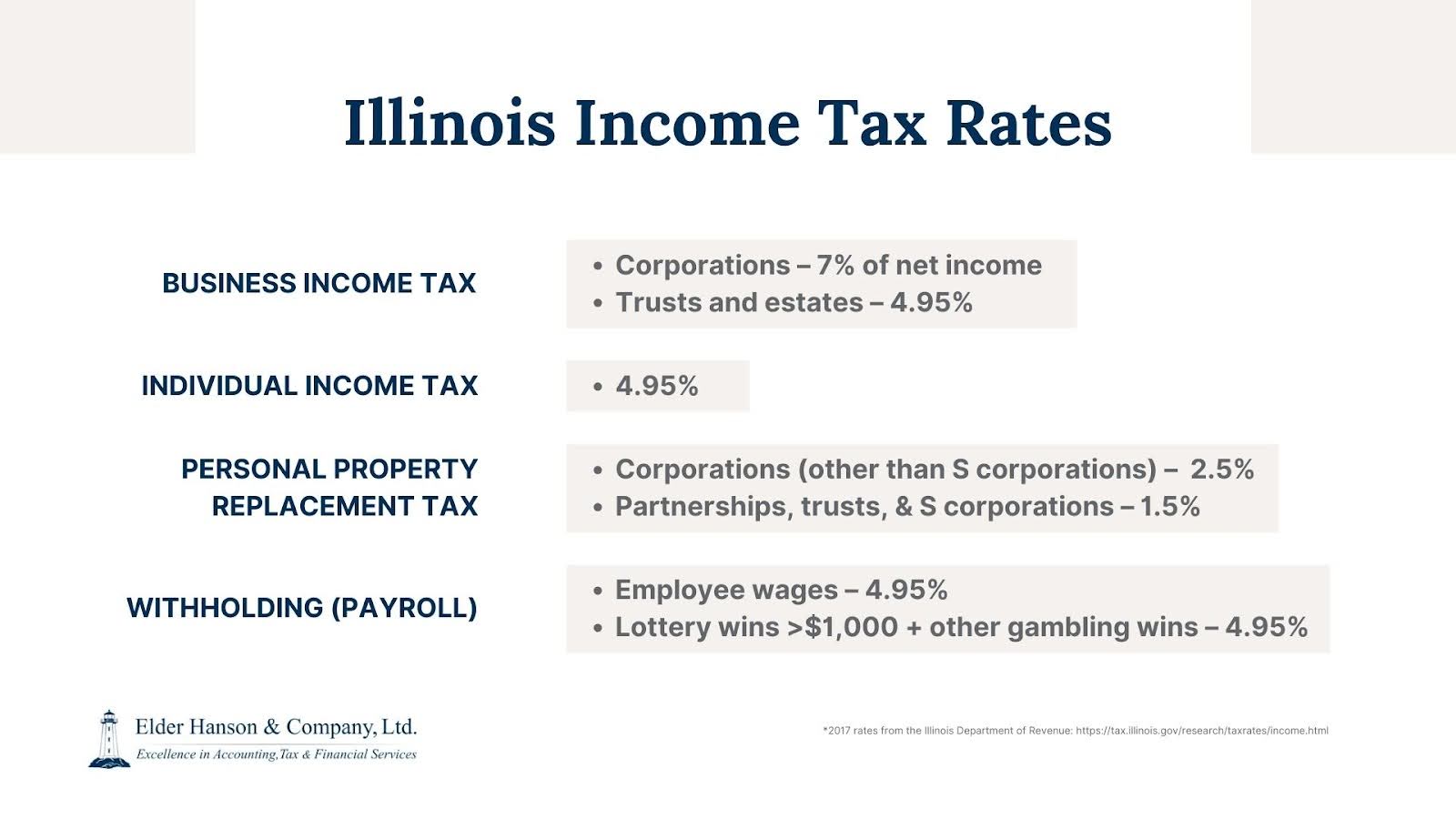

The season to pay taxes can be a stressful time, filled with paperwork and the looming possibility of a hefty bill. Below, you can see Illinois income tax rates for various filing types:

Illinois income tax consists of a flat rate of 4.95% applied to individual income, trust and estate net income, and withheld from wages (adjusted for allowances claimed), lottery winnings over $1,000 (both residents and non-residents), and certain gambling winnings for Illinois residents. There are separate tax rates for corporations and a personal property replacement tax for some business entities.

But don’t stress, there are many strategies you can employ to get a tax deduction. Here are 15 tips from our team at Elder Hanson & Company, Ltd. to help you lower your taxes.

1. Plan Throughout the Year, Not Just at Tax Time

Don’t wait until tax season to gather receipts and scramble for deductions. It’s best to regularly review your finances and keep track of potential tax breaks throughout the year. Consider consulting a tax professional early on to develop a personalized tax strategy with our income tax planning services.

2. Adjust Your Employee’s Withholding Allowance Certificate (W-4)

To better align your tax withholding with your tax liability, you can:

- Reduce Withholding If You Get Big Refunds: This means more money in your paycheck throughout the year. You might consider this if you had significant income changes, claimed large deductions or tax credits last year, or had two or more jobs at the same time.

- Increase Withholding if You Owe a Large Tax Bill: This helps avoid owing a big sum at tax filing time. You might do this if you didn’t withhold enough in taxes last year, had income from sources where taxes aren’t withheld (like self-employment or side gigs), or have multiple income sources.

3. Build Up College Savings

Saving for college can be tax-smart. While contributions to popular 529 plans may not be deductible on federal taxes, earnings grow tax-free and withdrawals for qualified expenses are tax-free as well. Check for state tax benefits and be mindful of gift tax limits. Remember, the sooner you start saving, the more compound interest can work its magic on your child’s future education.

4. Maximize Contributions to Retirement Accounts

Contributing to retirement accounts like 401(k)s and traditional IRAs may allow you to reduce your adjusted gross income (AGI) and your taxable income, which is the income used to determine your tax bracket. This usually lowers your income tax liability in the current tax year. Remember, with traditional IRAs and 401(k)s, your contributions are typically pre-tax, meaning they reduce your taxable income or come out of your paycheck before taxes are applied. With Roth IRAs, contributions are made with after-tax dollars, but your qualified withdrawals in retirement are tax-free.

How Do 401(k)s Work?

- Tax Advantage: Contributions to your 401(k) come directly out of your paycheck before taxes are applied. This means the money you contribute reduces your taxable income, potentially lowering your tax bill in the current year.

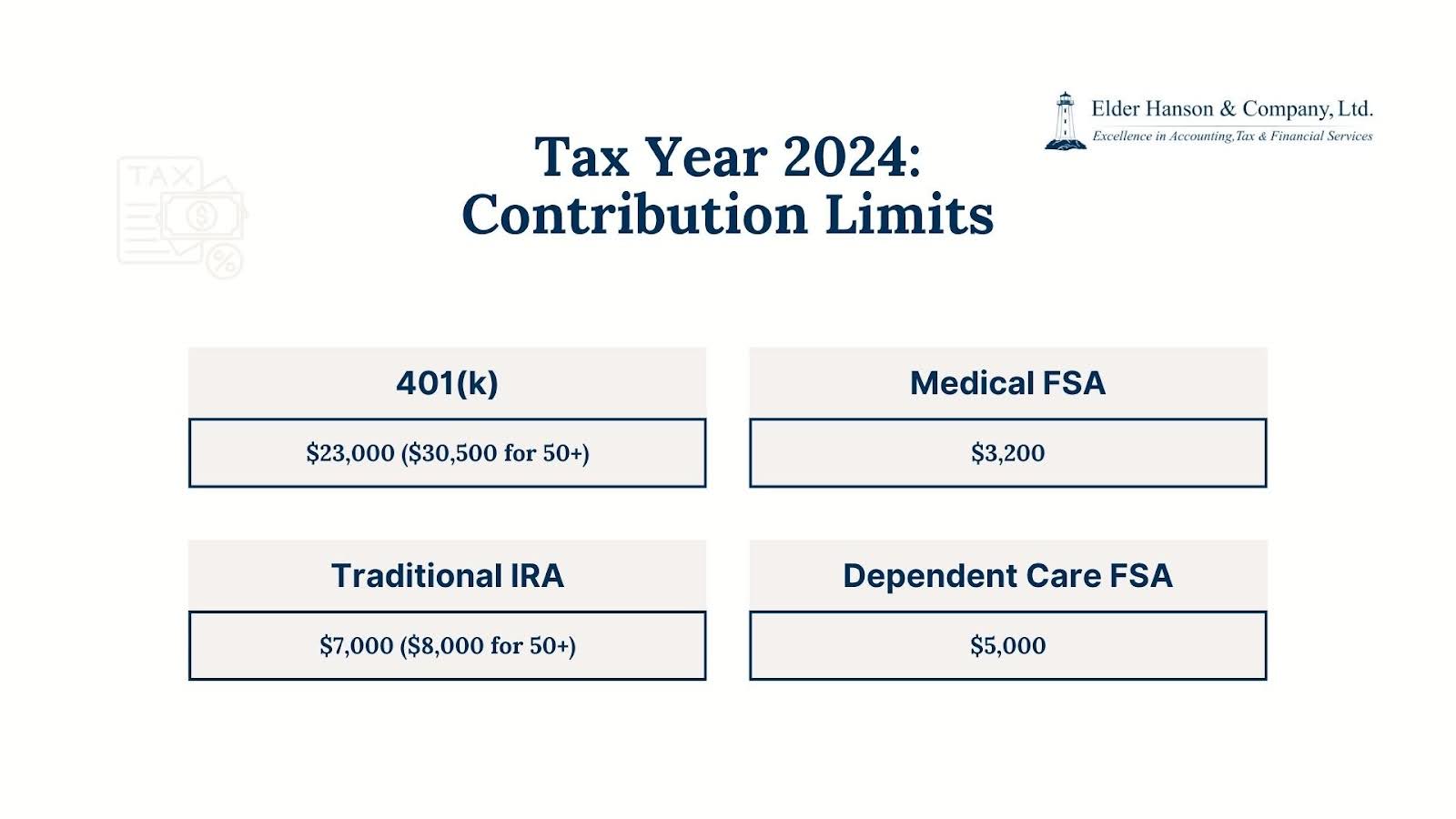

- Contribution Limits: In 2024, you can contribute up to $23,000 of your salary to a 401(k). If you’re 50 or older, you can take advantage of “catch-up contributions” and save an additional $7,500.

How Do Traditional IRAs Work?

While contributions to traditional IRAs can offer tax benefits, the deductibility of these contributions is subject to specific criteria. The key factors influencing deductibility hinge on whether you or your spouse participate in a workplace retirement plan and your overall income level, as measured by your modified adjusted gross income (MAGI).

For instance, considering tax year 2023 (returns filed in 2024), you may be ineligible for a full deduction on your IRA contributions if both these conditions are met:

- You are covered by a retirement plan at your workplace.

- You are married and filing your tax return jointly.

- Your combined MAGI exceeds $136,000.

These limitations are subject to annual adjustments, and for tax year 2024 (returns filed in 2025), the applicable MAGI limit for potential deduction phase-out increases to $143,000.

- Annual Limits: The IRS establishes contribution limits for IRAs each year. For tax year 2023 (filed in 2024), the limit was $6,500 per year, with an increase to $7,500 for individuals aged 50 or older. For tax year 2024 (filed in 2025), the contribution limit has been adjusted to $7,000 per year, with a “catch-up contribution” option of $8,000 available for those 50 and over.

- Contribution Deadline Flexibility: An important benefit to note is that you have until the tax filing deadline (typically April 15th) to fund your IRA for the previous tax year. This offers some flexibility in terms of managing your contributions throughout the year.

The Benefits of Roth IRAs

- Tax-Free Withdrawals: The tax-free nature of withdrawals in retirement can be a significant benefit, especially if you anticipate being in a higher tax bracket during your retirement years.

Flexibility: Roth IRAs offer more flexibility than traditional IRAs regarding withdrawals. Roth IRAs typically do not have required minimum distributions annually like traditional IRAs, thus giving you more flexibility regarding the timing of Roth IRA withdrawals.

5. Explore Health Savings Accounts (HSAs)

If you have a high-deductible health plan (HDHP), consider opening a health savings account (HSA). HSAs allow you to contribute pre-tax dollars to cover qualified medical expenses. Here are the features:

- Triple Tax Savings: HSAs save you on taxes in three ways: deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses;

- 2024 Contribution Limits: Self-only coverage is up to $4,150, family coverage is up to $8,300;

- 55+ Catch-Up: $1,000 extra contribution for those 55 or older;

- Account Options: Employer-sponsored or open your own at a bank/financial institution;

- 2024 Annual Deductibles: Self-only high-deductible health plans are required to have a minimum annual deductible of $1,600 and the self-only annual deductible and out-of-pocket expenses cannot exceed $8,050. Family high-deductible health plans are required to have a minimum annual deductible of $3,200 and the family annual deductible and out-of-pocket expenses cannot exceed $16,100.

Unleash Your Tax Savings Potential!

Schedule a consultation with our Naperville tax experts today and reduce your taxable income.

6. Take Advantage of Tax Credits

Tax credits are a dollar-for-dollar reduction of your tax liability, unlike deductions which only reduce your taxable income. Common federal tax credits include the Earned Income Tax Credit (EITC) for low- and moderate-income earners and the Child Tax Credit for families with children.

Be sure to see if you qualify for any available credits. This option is good for low- and moderate-income earners. Here are the characteristics for Married Filing Joint taxpayers:

| Limit | Value |

| Income limit for 2023 tax year (filed in 2024) with three children | Less than $63,398 |

| Maximum credit for 2023 tax year (filed in 2024) with three children | Up to $7,430 |

| Income limit for 2024 tax year (filed in 2025) with three children | Less than $66,819 |

| Maximum credit for 2024 tax year (filed in 2025) with three children | Up to $7,830 |

7. Consider Tax-Deductible Expenses

If you itemize deductions on your tax return (rather than taking the standard deduction), there are many tax-deductible expenses you can claim to lower your taxable income. These can include mortgage interest, state and local taxes paid (up to a limit), charitable contributions, and certain medical and dental expenses exceeding a specific percentage of your AGI.

8. Strategize with Capital Gains Tax

When you sell investments like stocks or bonds for a profit, you incur capital gains tax, of which there are two types: short-term (held for one year or less) and long-term (held for more than a year). Long-term capital gains typically have lower tax rates than ordinary income. Consider tax-loss harvesting which means selling investments at a loss to offset capital gains and potentially lower your capital gains tax bill.

9. Utilize Flexible Spending Accounts (FSAs)

Similar to an HSA, an FSA allows you to contribute pre-tax dollars to cover qualified medical and dependent care expenses. The funds typically roll over for a grace period but need to be used by the end of the plan year or they’ll be forfeited. Here are the sums:

- Pre-Tax Medical Savings: Contribute up to $3,200 (2024 limit) to an FSA to cover qualified medical and dental expenses (bandages, prescriptions, glasses) for yourself and dependents. Some employers offer rollover options.

- Dependent Care Savings: Contribute up to $5,000 pre-tax (2024 limit) to a dependent care FSA for child care (before/after school, daycare, preschool, camps) or elder care (check employer plan details).

10. Qualified Charitable Distributions from an IRA

Qualified Charitable Distributions (QCDs) for taxpayers age 70.5 years old or older is a nontaxable distribution made directly by the trustee of an IRA to an eligible charitable organization that can lower your taxable income.

11. Make Smart Charitable Contributions

If your itemized deductions are greater than your standard deduction you could consider donating appreciated assets like stocks instead of cash to potentially maximize your tax benefit. For larger donations, a donor-advised fund can offer additional tax advantages.

Generally, for charitable contributions that are itemized deductions for the 2023 tax year (filed in 2024), you can deduct between 20% and 60% of your AGI for qualified charitable donations.

12. Be Mindful of Required Minimum Distributions (RMDs)

For 2023, once you reach age 73 (or 70 ½ for those born before July 1, 1949), you are generally required to take minimum withdrawals from your traditional IRAs and employer-sponsored retirement plans. These RMDs are considered taxable income. Planning for RMDs can help you avoid a higher tax burden in your retirement years.

13. Consider Self-Employment Tax Deductions

If you’re self-employed, you can deduct many business expenses from your income tax return. This can include home office expenses, business travel, and certain equipment costs. Be sure to keep meticulous records of your business expenses to maximize your deductions.

14. Stay Updated on Tax Law Changes

The tax code can be complex and changes often. Staying informed about new tax laws and regulations can help you take advantage of any new tax cuts or credits that may be beneficial.

15. Seek Professional Help

Tax laws can be intricate, and navigating them can be overwhelming. If your tax situation is complex, consider consulting with a highly qualified Certified Public Accountant (CPA). They can help you develop a personalized tax strategy to make sure you’re taking advantage of all available deductions and credits, and file your tax return accurately and efficiently.

Take Control of Your Taxes: Unleash the Power of Income Tax Planning

These tips combined with staying informed about tax laws can help you lower taxable income and keep more of your hard-earned money. Remember, tax planning is an ongoing process, not a one-time event. Contact us at Elder Hanson & Company, Ltd. today to incorporate these strategies into your private or small business’s financial routine and make sure you’re minimizing your tax burden in Naperville and surrounding areas year after year.

FAQ

Does lowering taxable income increase your refund?

By lowering your taxable income, you can take advantage of tax benefits. This could result in a tax refund or a lower tax bill.

Why should you contribute to your HSA?

Contribute to your HSA for a triple tax benefit: reduce your taxable income with pre-tax contributions, watch your money grow tax-free, and withdraw funds tax-free for qualified medical and dental expenses. This is a powerful savings tool for healthcare costs when paired with a high-deductible health plan.

What are harvest losses?

Harvest losses involve strategically selling investments at a loss to offset capital gains taxes on profitable investments. This can significantly reduce your tax bill, but remember: prioritize long-term investment goals and consult a tax professional to make sure you’re following the rules.