CPA vs. Accountant: Main Differences

In the world of finance, navigating the intricacies of accounting and taxation can feel daunting. When seeking professional accounting services, you see terms like “accountant” and “Certified Public Accountant (CPA),” and are probably wondering if there’s a difference. The answer is yes, and understanding it can be crucial for choosing the right professional for your needs.

Here at Elder Hanson & Company, Ltd., we’re a team of experienced CPAs in Naperville passionate about empowering individuals and small businesses with financial clarity. Let’s delve into the key distinctions between CPAs and accountants, to help you make informed decisions.

What Is a CPA vs. Accountant?

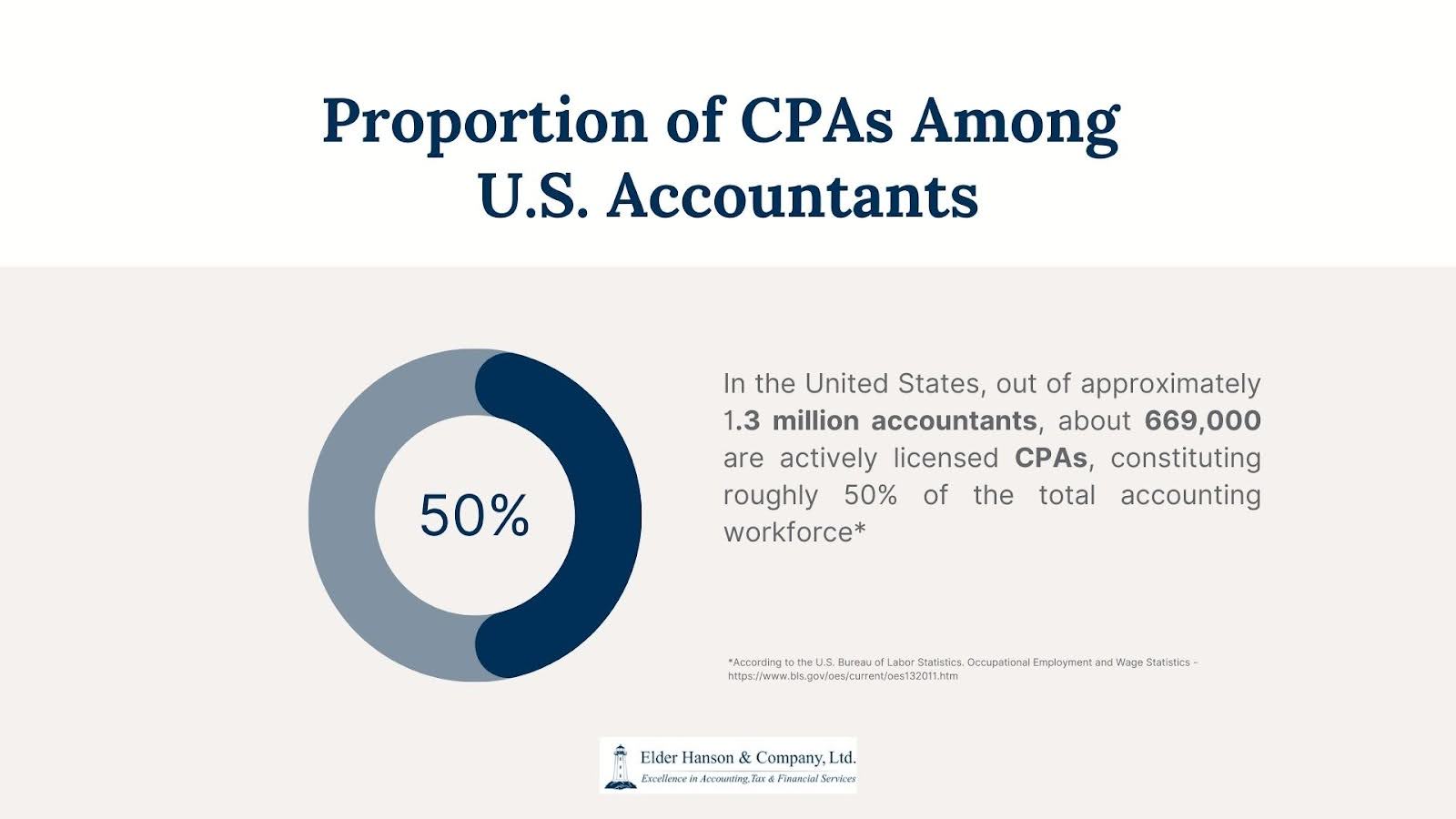

While the concept of an “accountant” is wider, a certified public accountant is a licensed professional accountant with expertise in auditing, tax strategies, and complex financial matters.

Accountant vs. CPA: Roles and Skills

Both CPAs and accountants play key roles in the financial health of individuals and businesses. They share core competencies in managing financial records, preparing financial statements (like income statements and balance sheets), and ensuring financial data accuracy. However, CPAs have a broader skill set due to their rigorous licensing requirements.

CPAs provide specialized services like auditing and financial consulting, while non-certified accountants focus on routine financial tasks such as recording and reporting.

Here, you can see the services typically provided by CPAs:

|

Services by CPAs |

Description |

|

CPAs can navigate intricate tax situations, developing sophisticated tax planning strategies for individuals with significant assets or income, businesses, and those with complex financial situations. They can also advise on long-term tax planning goals like retirement planning or estate planning. |

|

|

CFO Services & Consulting on Complex Business Matters |

Their expertise extends beyond basic accounting functions, encompassing chief financial officer services, financial planning, business valuation, and risk management. |

|

Auditing Financial Statements |

They offer independent verification of a company’s financial health, ensuring accuracy and compliance with accounting standards. This service is important for publicly traded companies, businesses that need bank loans, and those seeking investment. |

|

Representing Clients Before the Internal Revenue Service (IRS) |

During a tax audit, a CPA can advocate on your behalf to protect your rights and ensure a fair outcome. |

This table shows the services performed by regular accountants:

|

Services by Accountants |

Description |

|

Bookkeeping Services & Record-Keeping |

Accountants track financial transactions, categorize them according to accounting principles, and generate reports for internal use. |

|

Tax Preparation |

They help individuals and businesses in filing accurate tax returns to ensure compliance with tax codes. |

|

They handle the timely and accurate calculation and disbursement of employee salaries and withholdings. |

|

|

Financial Statement Preparation |

This involves creating accurate and informative financial statements (income statements, balance sheets, cash flow statements) that reflect a company’s financial activity for a specific period. Accountants gather financial data from various sources (sales records, expense reports, bank statements), categorize it according to accounting principles, and then present it in a clear and standardized format. |

|

The services include setting up your chart of accounts, managing bookkeeping tasks (data entry, bill payments, expense tracking), generating financial reports (income statements, balance sheets, cash flow statements), reconciling bank statements, and providing ongoing support for efficient QuickBooks use. |

Credentials, Qualifications, and Training

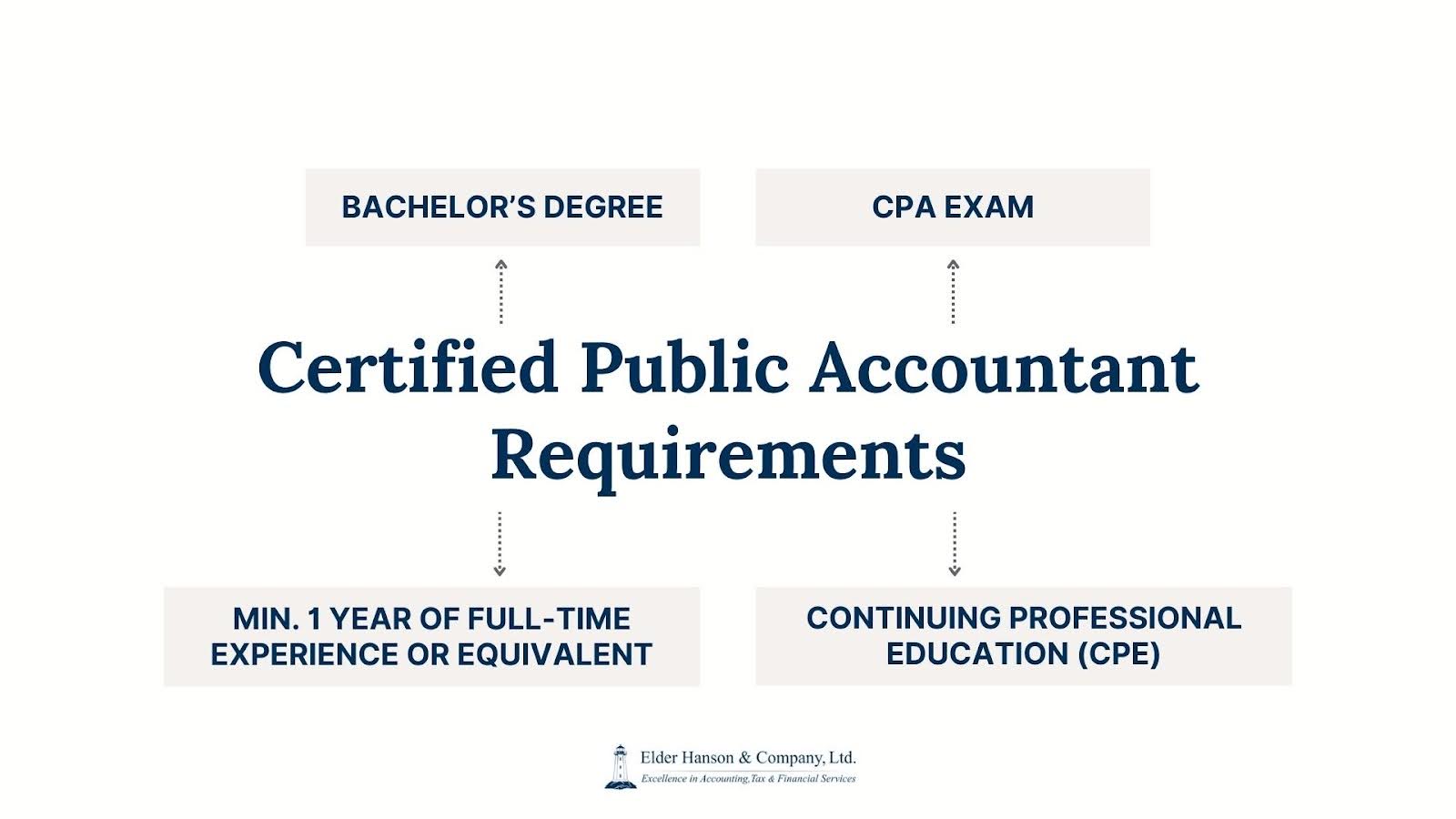

The key distinction between CPAs and accountants lies in their credentials. CPAs are licensed by the Boards of Accountancy. As you can imagine, earning a CPA designation requires a rigorous journey:

- Bachelor’s Degree: A bachelor’s degree in accounting or a closely related field is the first step.

- Uniform CPA Examination (CPA Exam): This comprehensive exam tests candidates on accounting and auditing principles, taxation, business law, and ethics.

- Experience Requirements: Most states mandate a specific amount of work experience under a licensed CPA before obtaining the license. In Illinois, applicants need a minimum of one year of full-time experience, or equivalent, utilizing their skills in accounting, attestation, management advisory services, financial advisory services, taxation, or consulting.

- Continuing Professional Education (CPE): To maintain their license, CPAs must fulfill ongoing CPE requirements, ensuring their knowledge remains current with complex financial regulations.

In Illinois, preparation for the CPA exam is provided by, for example, the following educational organizations:

- Gies College of Business (University of Illinois Urbana-Champaign): CPA Pathways Graduate Certificate;

- Eastern Illinois University: Accountancy Program;

- DePaul University School of Accountancy & MIS;

- Harper College;

- University of Illinois Tax School.

Accountants, on the other hand, may not hold any formal licenses. Some may have an accounting degree, while others may have relevant work experience or certifications like Certified Management Accountant (CMA) or Chartered Financial Analyst (CFA). These certifications offer specialized knowledge in specific areas of finance but don’t equate to the broad expertise and legal recognition of a CPA license.

Empower Your Financial Future!

Schedule a consultation with our experienced CPAs in Naperville for clarity and growth.

Working with Taxes and Regulations

Both CPAs and accountants can help with tax preparation. However, their capabilities differ:

- CPAs have a deeper understanding of complex tax codes and regulations. They can navigate intricate tax situations, optimize tax strategies, and represent you during an IRS audit. They’re also authorized to prepare tax returns for all types of entities, including corporations, S-corporations, partnerships, and estates.

- Accountants, particularly those without a focus on taxation, may be limited in handling complex tax situations. While they can prepare basic tax returns, they might not be able to help you lower taxable income or navigate tax audits.

Code of Ethics and Requirements

All accounting professionals, including CPAs and non-certified accountants, are expected to adhere to high ethical standards. However, CPAs are bound by a stricter code of ethics set forth by the American Institute of Certified Public Accountants (AICPA). This code emphasizes principles like integrity, independence, and objectivity to make sure clients receive unbiased and professional service.

Additionally, CPAs are subject to stricter fiduciary responsibility. This means they have a legal duty to act in their client’s best interest and avoid conflicts of interest.

Accounting Firm vs. CPA Firm: Making the Right Choice

Having explored the key differences between CPAs and accountants, you might wonder which professional best suits your needs. We’ve provided a breakdown to help you decide:

When to Choose a CPA

- Your business requires audited financial statements for regulatory compliance or investment purposes.

- You anticipate a complex tax audit and need representation before the IRS.

- You require in-depth financial planning and strategic business consulting.

- You’re dealing with intricate financial matters like estate planning or complex business valuations.

When an Accountant Might Suffice

- You need assistance with basic bookkeeping and record-keeping for a small business.

- Your tax situation is relatively straightforward, and you require standard tax return preparation.

- You’re a sole proprietor or freelancer with uncomplicated financial needs.

Navigate Your Naperville Financial Journey with Expert CPAs

Though non-certified accountants offer useful services, they may lack the comprehensive skills that a Certified Public Accountant (CPA) maintains. At Elder Hanson & Company in Naperville, our team of highly qualified CPAs and advisors is ready to meet the needs of both private individuals and small businesses. Contact us today to learn how our passionate and friendly experts can help you reach your financial goals.

FAQ

Is an accountant better than a CPA?

Not quite. A CPA is an accountant, but with extra credentials. A CPA has undergone rigorous education, experience, and examination requirements to earn a license. This means a higher level of expertise and gives them the ability to perform specific services that unlicensed accountants cannot.

What is the difference between a CPA and a financial accountant?

There’s overlap, but a CPA can do more. A financial accountant focuses on a company’s finances, while a CPA can do that and also audit other companies, advise on taxes, and more.